How To Calculate Tax Return For Self Employed . 20% on profits between £12,571 and £50,270. The business income is part of the total.

from db-excel.com

The business income is part of the total. If your expenses are less than your income, the difference is net profit and becomes part of your income on page 1 of form 1040 or. You will then need to pay income tax at a rate of:

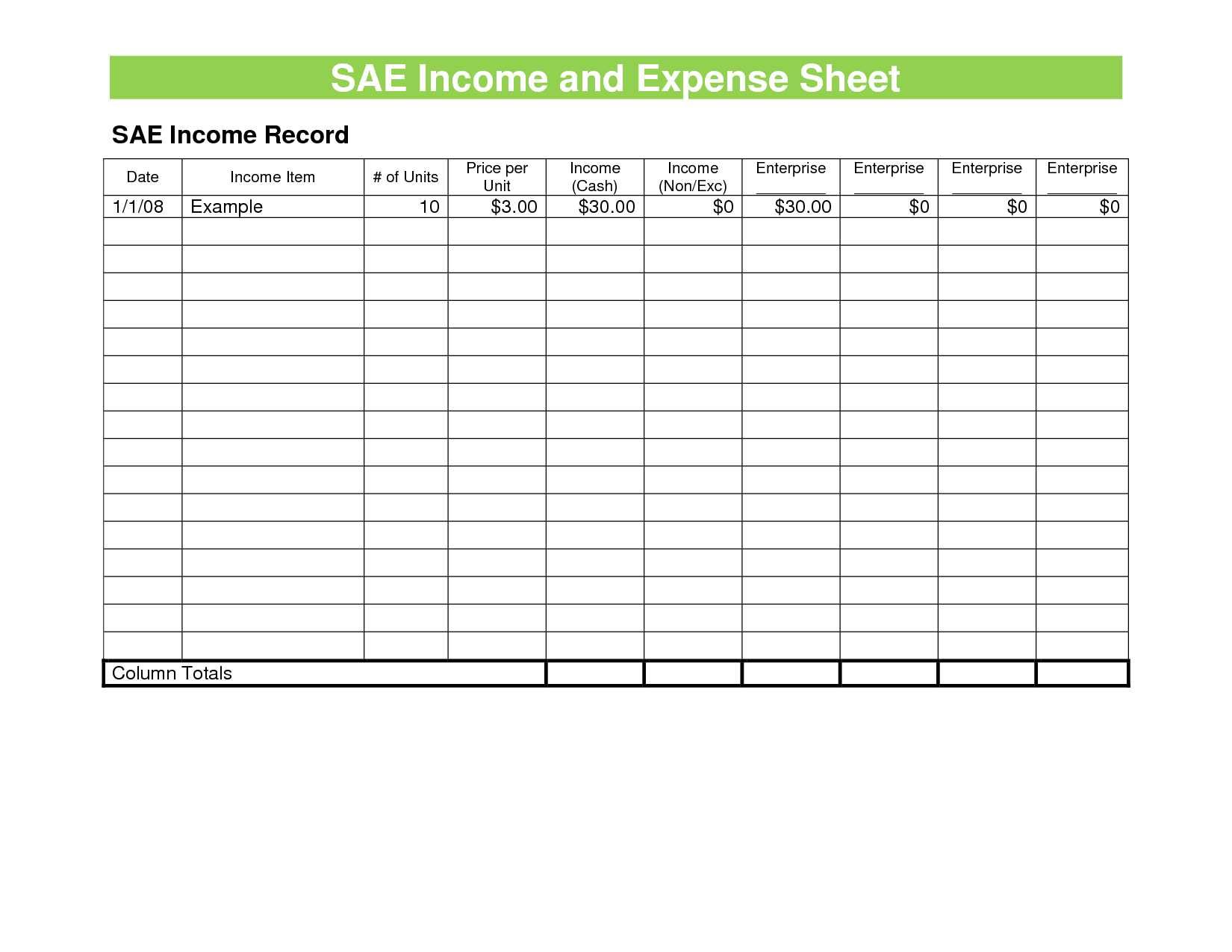

Self Employed Tax Spreadsheet Spreadsheet Downloa self employed tax

How To Calculate Tax Return For Self Employed You will then need to pay income tax at a rate of: The business income is part of the total.to calculate your profits for the tax year, you deduct your business expenses from your total income.you do this by subtracting your business expenses from your business income.

From www.pinterest.com

How to Calculate Self Employment Tax Self employment, Business tax How To Calculate Tax Return For Self Employed The business income is part of the total. 20% on profits between £12,571 and £50,270.to calculate your profits for the tax year, you deduct your business expenses from your total income. You will then need to pay income tax at a rate of: If your expenses are less than your income, the difference is net profit and becomes. How To Calculate Tax Return For Self Employed.

From www.expatustax.com

Pay Self Employment Tax Expat US Tax How To Calculate Tax Return For Self Employed You will then need to pay income tax at a rate of: The business income is part of the total. 20% on profits between £12,571 and £50,270. If your expenses are less than your income, the difference is net profit and becomes part of your income on page 1 of form 1040 or.you do this by subtracting your. How To Calculate Tax Return For Self Employed.

From www.keepertax.com

How to File SelfEmployment Taxes, Step by Step Your Guide How To Calculate Tax Return For Self Employed You will then need to pay income tax at a rate of:you do this by subtracting your business expenses from your business income. 20% on profits between £12,571 and £50,270.to calculate your profits for the tax year, you deduct your business expenses from your total income. If your expenses are less than your income, the difference. How To Calculate Tax Return For Self Employed.

From www.youtube.com

How to Understand and Calculate Selfemployment Tax (SE Tax)? YouTube How To Calculate Tax Return For Self Employedyou do this by subtracting your business expenses from your business income. 20% on profits between £12,571 and £50,270.to calculate your profits for the tax year, you deduct your business expenses from your total income. If your expenses are less than your income, the difference is net profit and becomes part of your income on page 1. How To Calculate Tax Return For Self Employed.

From jacedillan.blogspot.com

Self employed tax refund calculator JaceDillan How To Calculate Tax Return For Self Employed The business income is part of the total. 20% on profits between £12,571 and £50,270.you do this by subtracting your business expenses from your business income. If your expenses are less than your income, the difference is net profit and becomes part of your income on page 1 of form 1040 or.to calculate your profits for. How To Calculate Tax Return For Self Employed.

From www.etsy.com

2021 Federal Tax & Self Employment Tax Calculator Etsy How To Calculate Tax Return For Self Employed You will then need to pay income tax at a rate of:to calculate your profits for the tax year, you deduct your business expenses from your total income. The business income is part of the total. If your expenses are less than your income, the difference is net profit and becomes part of your income on page 1. How To Calculate Tax Return For Self Employed.

From www.projectcubicle.com

Tax Tips for Bloggers How to Calculate SelfEmployment Taxes How To Calculate Tax Return For Self Employed If your expenses are less than your income, the difference is net profit and becomes part of your income on page 1 of form 1040 or. 20% on profits between £12,571 and £50,270.you do this by subtracting your business expenses from your business income.to calculate your profits for the tax year, you deduct your business expenses. How To Calculate Tax Return For Self Employed.

From www.hellobonsai.com

Selfemployed tax calculator How To Calculate Tax Return For Self Employedyou do this by subtracting your business expenses from your business income. 20% on profits between £12,571 and £50,270. You will then need to pay income tax at a rate of: The business income is part of the total.to calculate your profits for the tax year, you deduct your business expenses from your total income. How To Calculate Tax Return For Self Employed.

From db-excel.com

Self Assessment Tax Return Spreadsheet Template inside Calculating An How To Calculate Tax Return For Self Employedto calculate your profits for the tax year, you deduct your business expenses from your total income. You will then need to pay income tax at a rate of: The business income is part of the total. If your expenses are less than your income, the difference is net profit and becomes part of your income on page 1. How To Calculate Tax Return For Self Employed.

From www.youtube.com

How to do SelfEmployed Tax Return in Canada YouTube How To Calculate Tax Return For Self Employed You will then need to pay income tax at a rate of: 20% on profits between £12,571 and £50,270. If your expenses are less than your income, the difference is net profit and becomes part of your income on page 1 of form 1040 or. The business income is part of the total.to calculate your profits for the. How To Calculate Tax Return For Self Employed.

From www.pinterest.com

Self Employment Tax Calculator How Much Will Your Self Employment Tax How To Calculate Tax Return For Self Employed If your expenses are less than your income, the difference is net profit and becomes part of your income on page 1 of form 1040 or.you do this by subtracting your business expenses from your business income. 20% on profits between £12,571 and £50,270. The business income is part of the total.to calculate your profits for. How To Calculate Tax Return For Self Employed.

From www.businessmole.com

SelfEmployed Tax Return in the UK A StepbyStep Guide BusinessMole How To Calculate Tax Return For Self Employed 20% on profits between £12,571 and £50,270.to calculate your profits for the tax year, you deduct your business expenses from your total income. The business income is part of the total. You will then need to pay income tax at a rate of: If your expenses are less than your income, the difference is net profit and becomes. How To Calculate Tax Return For Self Employed.

From incometaxdeductionssuikoku.blogspot.com

Tax Deductions Tax Deductions Self Employed How To Calculate Tax Return For Self Employedto calculate your profits for the tax year, you deduct your business expenses from your total income. You will then need to pay income tax at a rate of: If your expenses are less than your income, the difference is net profit and becomes part of your income on page 1 of form 1040 or. The business income is. How To Calculate Tax Return For Self Employed.

From www.youtube.com

How to calculate your taxes (selfemployed) YouTube How To Calculate Tax Return For Self Employed 20% on profits between £12,571 and £50,270.to calculate your profits for the tax year, you deduct your business expenses from your total income.you do this by subtracting your business expenses from your business income. The business income is part of the total. You will then need to pay income tax at a rate of: How To Calculate Tax Return For Self Employed.

From www.wikihow.com

2 Easy Ways to Calculate Self Employment Tax in the U.S. How To Calculate Tax Return For Self Employedto calculate your profits for the tax year, you deduct your business expenses from your total income.you do this by subtracting your business expenses from your business income. 20% on profits between £12,571 and £50,270. You will then need to pay income tax at a rate of: If your expenses are less than your income, the difference. How To Calculate Tax Return For Self Employed.

From oldmymages.blogspot.com

How To Calculate Tax Return Self Employed Oldmymages How To Calculate Tax Return For Self Employed You will then need to pay income tax at a rate of:to calculate your profits for the tax year, you deduct your business expenses from your total income. The business income is part of the total.you do this by subtracting your business expenses from your business income. 20% on profits between £12,571 and £50,270. How To Calculate Tax Return For Self Employed.

From www.pinterest.com

Self Employed Tax Preparation Printables Instant Download Etsy in How To Calculate Tax Return For Self Employed If your expenses are less than your income, the difference is net profit and becomes part of your income on page 1 of form 1040 or. The business income is part of the total. You will then need to pay income tax at a rate of:you do this by subtracting your business expenses from your business income. Web. How To Calculate Tax Return For Self Employed.

From gusto.com

How to Calculate Your SelfEmployment Tax In 4 Simple Steps Gusto How To Calculate Tax Return For Self Employedto calculate your profits for the tax year, you deduct your business expenses from your total income. The business income is part of the total.you do this by subtracting your business expenses from your business income. 20% on profits between £12,571 and £50,270. If your expenses are less than your income, the difference is net profit and. How To Calculate Tax Return For Self Employed.